The rise of local stablecoins

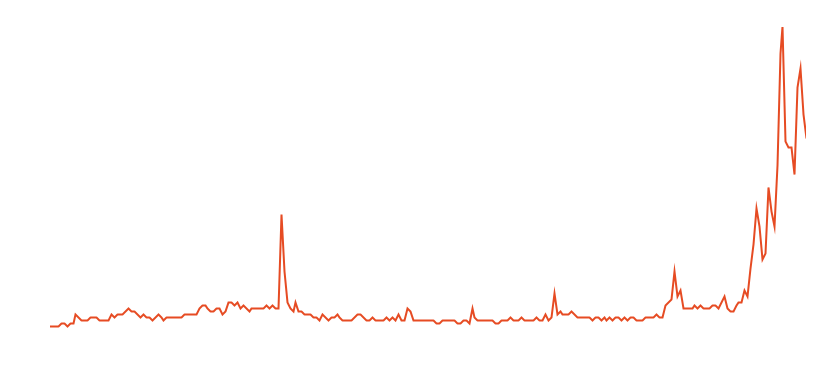

Stablecoins have become one of the dominant technological themes of 2025. Public attention has grown at an unprecedented pace: search interest for “stablecoins” on Google surged more than 10× compared to previous years, major global media outlets now cover the topic on a weekly basis, and institutions such as the World Economic Forum (WEF) and the International Monetary Fund (IMF) have placed stablecoins at the center of their policy discussions. Several global banks have announced their own stablecoin initiatives, and regulatory frameworks are being introduced across jurisdictions, including the U.S. GENIUS Act and Brazil’s newly implemented stablecoin rules.

Interest Over Time on Stablecoins (Google Trends)

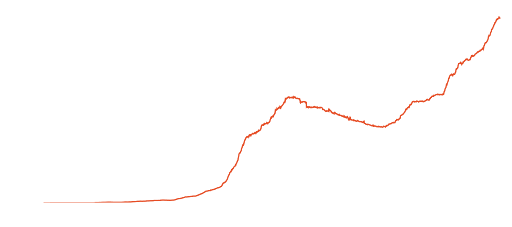

This visibility is supported by data. In 2025, the stablecoin market cap surpassed US$ 300 billion, maintaining strong resilience and exhibiting lower correlation to broader crypto market cycles compared to previous years. Even more striking is the operational scale, and on-chain stablecoin settlement volumes have already exceeded those of Visa, Mastercard, and other major payment networks combined, a milestone that signals the emergence of a new global settlement layer.

Stablecoin Market Cap

But despite this impressive momentum, today’s stablecoin ecosystem remains incomplete. The overwhelming majority of stablecoins in circulation are USD-denominated , and while they excel at providing global liquidity, they fall short in enabling a truly borderless financial system. For such a system to exist, local economies must be integrated — not bypassed. This is where local stablecoins become essential.

Local Stablecoins: The Missing Infrastructure Layer

Local stablecoins are more than digital representations of domestic currencies. They provide the foundation for locally grounded, globally connected financial rails, bridging the gap between the efficiency of blockchain networks and the practical realities of daily economic activity in emerging markets.

While USD stablecoins support global liquidity flows, they are not a substitute for domestic money. People and businesses in emerging markets need to:

- pay employees and contractors

- settle local taxes and mandatory contribuitions

- pay suppliers

- manage operational cash flows

- comply with local regulators

- denominate prices and contracts in local currency

USD stablecoins do not eliminate the need for these functions. Instead, they create a new dependency: the constant need to convert back into local currency. This leads to several practical challenges:

- Operational friction — Businesses must off-ramp frequently to meet daily obligations, adding cost and time.

- Planning uncertainty — Revenue, expenses, and forecasting become difficult when FX exposure is constant

- Lost economic position — In 2024–2025, for example, the Brazilian real appreciated against the dollar, meaning individuals and businesses holding USD stablecoins lost local purchasing power.

- Noncompetitive yields — With domestic interest rates in countries like Brazil reaching ~15%, the limited yield opportunities in USD stablecoins become unattractive.

Local stablecoins address all these constraints simultaneously. They allow users to hold value in the currency they actually operate in, unlock yield opportunities that are aligned with domestic monetary policy, and eliminate the structural inefficiencies of frequent conversion.

Programmable Local Money and the Emergence of On-Chain FX

One of the most transformative properties of local stablecoins is that they introduce programmable money at the domestic level. With local currencies existing natively on-chain, developers and institutions can build financial products directly on top of them, including:

- programmable payroll systems

- local credit and lending markets

- tokenized invoices and receivables

- domestic payment rails integrated with global liquidity

- SME financing and trade finance

- insurance and risk tools

- escrow and conditional settlement mechanisms

This shift transforms blockchain from a dollar-centric settlement layer into a complete financial stack, capable of supporting end-to-end domestic and international operations.

Local stablecoins also unlock the possibility of on-chain foreign exchange. Instead of relying on traditional intermediaries, FX can be executed directly through automated market makers and liquidity pools. AMMs such as Uniswap (and other emerging models) allow liquidity to be concentrated, markets to remain open 24/7, and pricing to be transparent. With proper liquidity depth and stable local currency tokens, FX can become faster, cheaper, programmable, composable with other financial functions and global by default.

This aligns blockchain with the long-term vision of a financial system where money moves as freely and as quickly as data.

Market Growth: Early Signals of a Rapid Expansion Curve

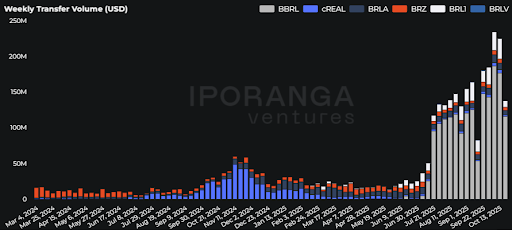

The local stablecoin ecosystem in Latin America is growing rapidly while still being in its early stages. Total transacted volume for 2025 has already reached US$ 4.8 billion (R$ 25.6 billion) across Brazil, Mexico, and Colombia. Projections suggest this figure will exceed US$ 6 billion (R$ 32 billion) by year-end.

Beyond this, institutional participation is accelerating sharply:

- Last year, institutional flows represented only 5% of volume.

- In 2025, they represent 84%.

This structural shift parallels adoption curves seen in earlier financial innovations (e.g., PIX, SPEI, real-time payments), where institutional adoption typically precedes mass consumer use.

Yet the market remains early. Local stablecoins currently account for only a small share of, ComEx settlements, remittances, corporate cross-border flows, merchant payments, on-chain liquidity markets.

As adoption increases across these verticals, the market is likely to expand by multiples.

Evolving Ecosystem: Issuers, FX Enablers, Payment Companies, and DeFi Infrastructure

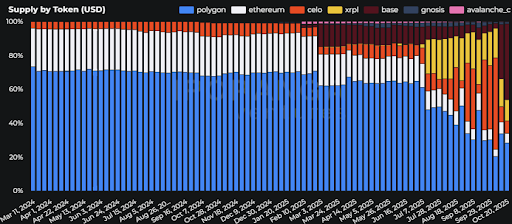

Latam stablecoin activity varies meaningfully across blockchains. In 2025, Base experienced rapid growth, driven largely by the launch of Crown's yield bearing stablecoin. Base now holds the largest share of total volume. And Polygon remains the second largest chain by volume, benefiting from low fees and existing integrations with emerging-market financial applications, with some applications on yield and most of its volumes coming from the fx market.

Active Addresses and User Behavior

Local stablecoins currently have around 80,000 total active addresses, with 7% of them transacting weekly. Weekly active usage sits around 5 thousand addresses, signaling that engagement is not only rising but becoming consistent.

This profile mirrors early adoption patterns in digital payments systems, where an early core of recurring users drives liquidity and stability before mass-scale usage emerges.

Supply and Liquidity Expansion

The total supply of local stablecoins has reached US$46.7 million, distributed across 11 blockchains, indicating both technological diversification and early standardization.

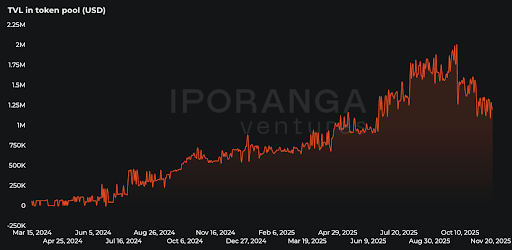

On-chain liquidity has also expanded significantly:

- Liquidity reached US$ 2 million (R$ 10.62 million) in October 2025.

- This represents 262% growth compared to the US$ 618 thousand (R$ 3.29 million) of the previous year.

Growing liquidity reduces slippage, improves price stability, and allows for more predictable settlement — important attributes for FX and payment applications.

Swap Volume and the Rise of On-Chain FX

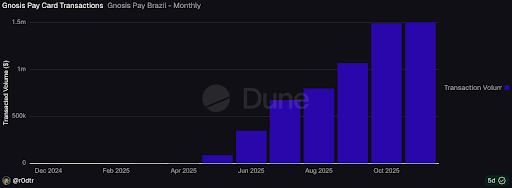

A striking insight from this year’s data is the composition of transaction volume. We estimate that over 90% of swap volume is related to on-chain FX operations, supporting, cross-border payments, remittance transactions, stablecoin-backed credit card operations, corporate treasury flows, and more.

We can highlight here players like Avenia that have pairs of BRLA/USD in DEXs supporting the operation of the Gnosis Pay/Picnic card, that is being used to pay for over $1.5mn monthly.

This demonstrates that local stablecoins are not being used primarily for speculation — they are supporting real economic activity. The market is transitioning from experimentation to functional adoption.

The Path Forward: Local Stablecoins as Core Financial Infrastructure

Taken together, these developments illustrate a broader structural shift. Local stablecoins are emerging as critical infrastructure for the next phase of digital finance. They bring together, the programmability of blockchain, the connection with domestic currencies, the efficiency of global liquidity rails and the composability of DeFi

They enable local economies to operate digitally while remaining connected to global markets. As on-chain FX markets mature, liquidity deepens, and institutional usage grows, local stablecoins will likely become one of the foundational layers of a more open, interoperable, and efficient financial system.

In other words, local stablecoins are not simply digital representations of fiat currencies — they are the building blocks of the next-generation financial architecture, one capable of supporting both local realities and global ambitions.